Digital 2025: The UAE & KSA

Today we launched Digital 2025: Saudi Arabia and Digital 2025: The UAE, part of our series of annual global digital reports. They are comprehensive reports covering digital, social and mobile use in the region.

This isn’t just another data drop: it’s your blueprint for a winning 2025 social media strategy. These insights uncover real shifts in consumer behaviour, platform power plays, and the evolving tactics brands need to stay ahead.

Shift #1: Engagement is the new currency

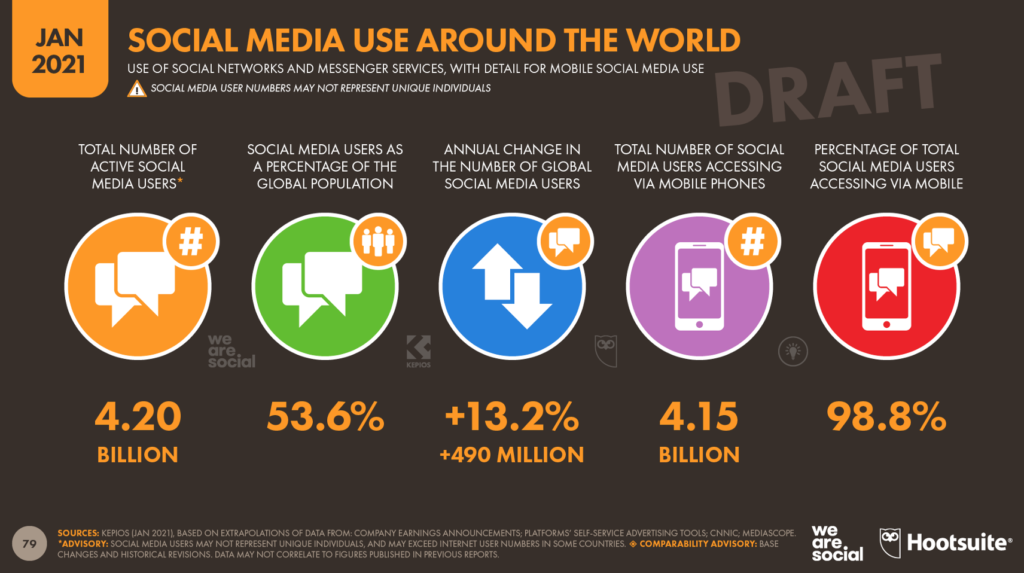

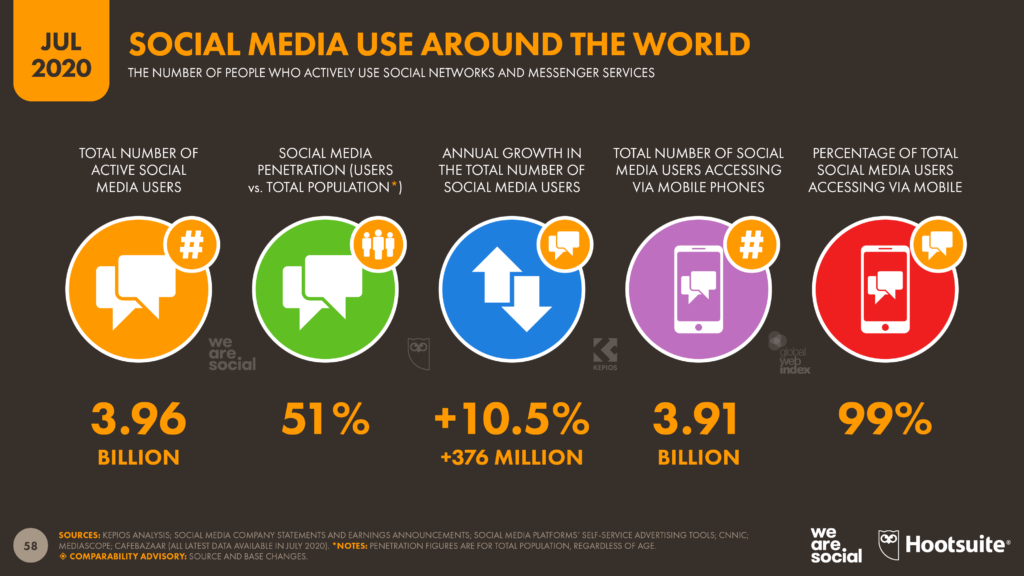

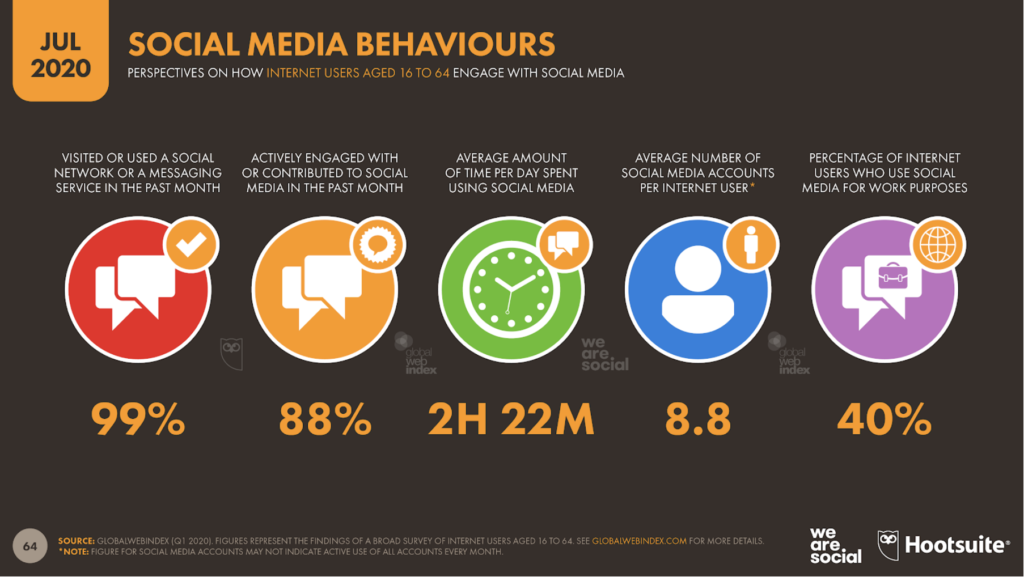

Some might say we’ve reached the pinnacle—100% of the UAE population is on social media, 99.6% for KSA. Social adoption isn’t the challenge anymore—holding attention is.

With near-total penetration, engagement isn’t just a metric:it’s the new currency of digital success. Algorithms reward interaction, not presence. Audiences dictate reach, not brands. If people aren’t engaging, the content isn’t seen.

The real competition isn’t for more users, it’s for more time, more interaction, and more loyalty. Consumers aren’t endlessly scrolling; they’re curating their feeds, choosing who they follow, and filtering out content that doesn’t serve them. Users are deciding what they engage with, muting the noise, and giving their attention only to what feels entertaining, informative, or valuable to them.

Brands can make the most of it by prioritizing quality over quantity, focusing on fewer but more locally relevant and high-quality posts that resonate with the audience.

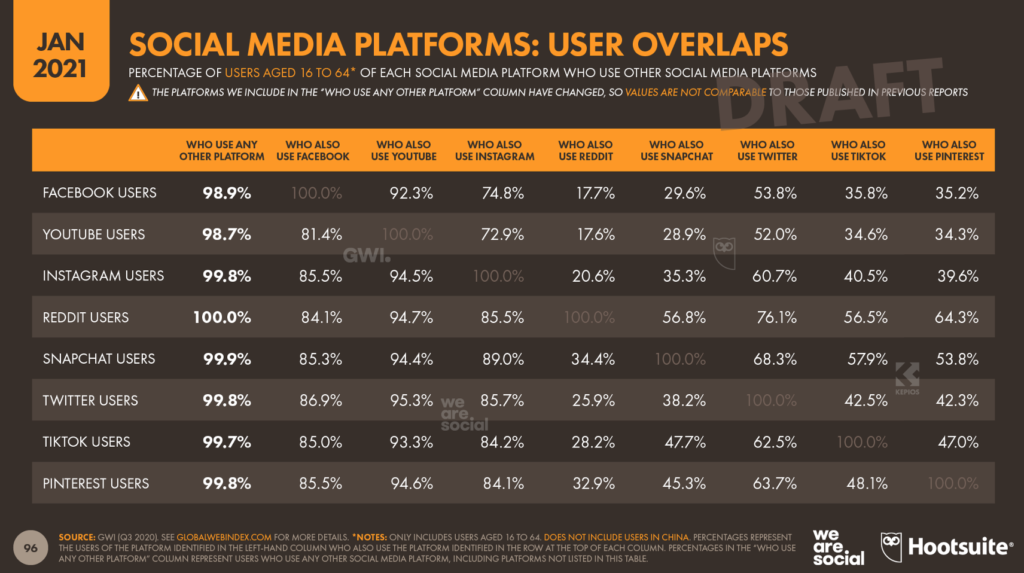

Shift #2: The social platform shakeup

It’s not just about where people are:it’s about why they’re there.

In the UAE, LinkedIn’s ad reach grew by 19%, signaling a shift in how professionals and businesses engage with social. Whether it’s a stronger focus on career-building, more businesses using social strategically, or the need for credibility in a professional setting, LinkedIn is becoming a go-to space for industry conversations.

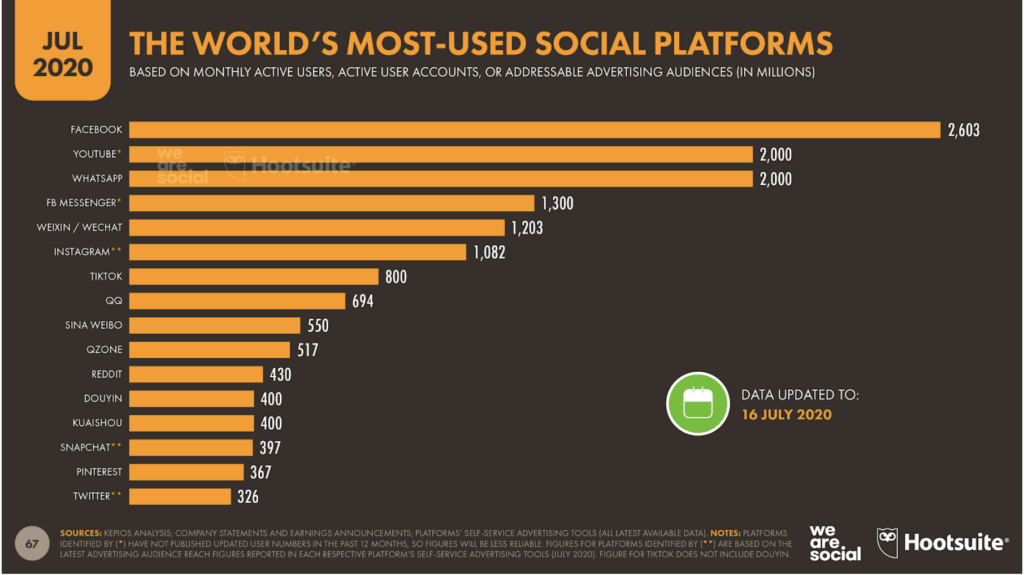

Meanwhile, TikTok has overtaken Snapchat in Saudi Arabia, growing 4.8% in ad reach, reinforcing its role as the leading platform for discovery-driven, entertainment-first content.

Not all platforms are thriving, X (Twitter) is losing traction, down 6.9% in KSA and 3.6% in the UAE, while YouTube’s ad reach has declined (-6.5% UAE, -3.9% KSA). But video isn’t disappearing—it’s shifting. Short-form video is dominating on TikTok and Instagram, and even X is prioritizing video engagement. The question isn’t whether people are watching, but where and how they’re consuming.

The way people engage with platforms is evolving. It’s not just about where they are, but what they’re looking for.

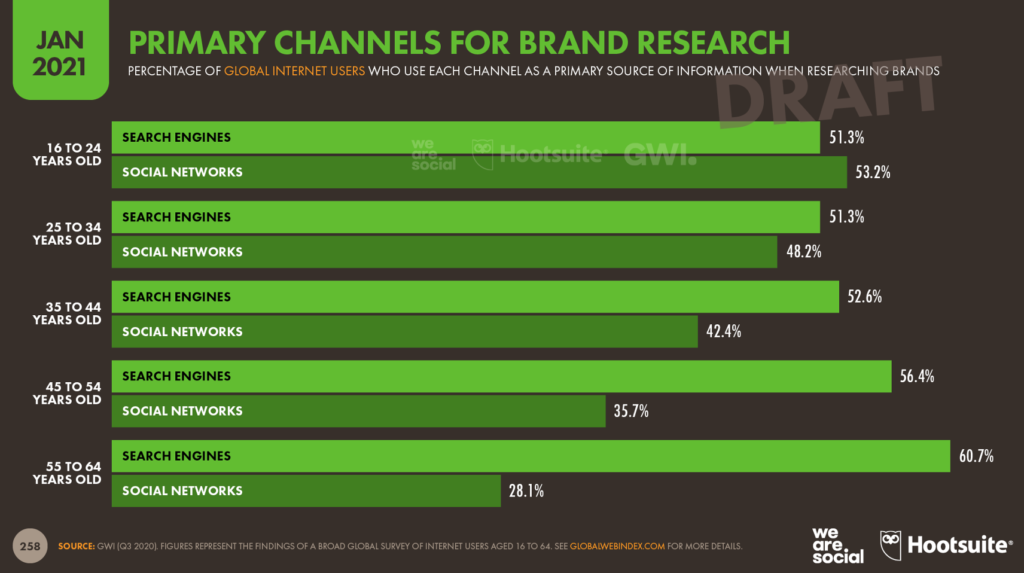

Shift #3: Search is leading for brand discovery

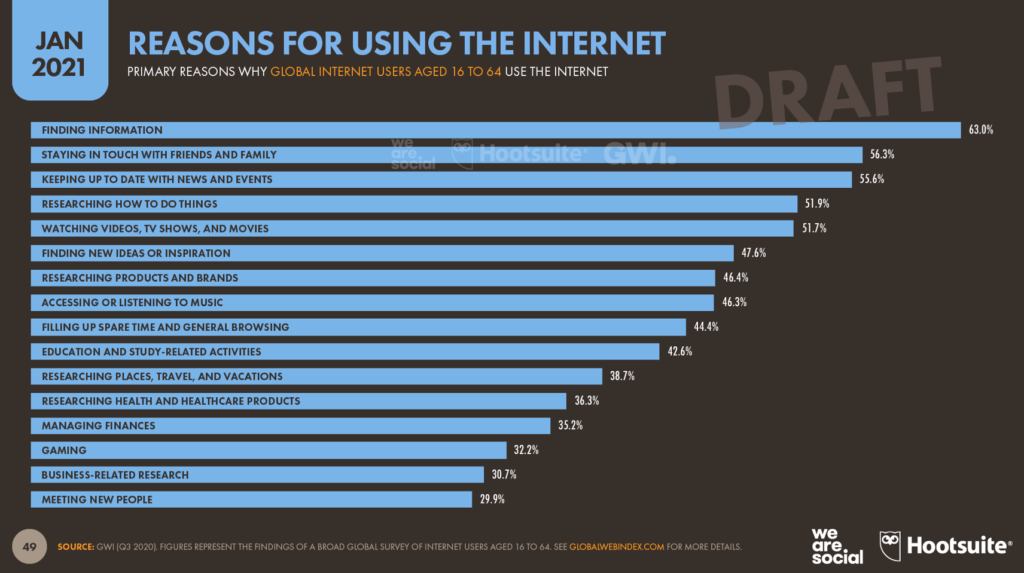

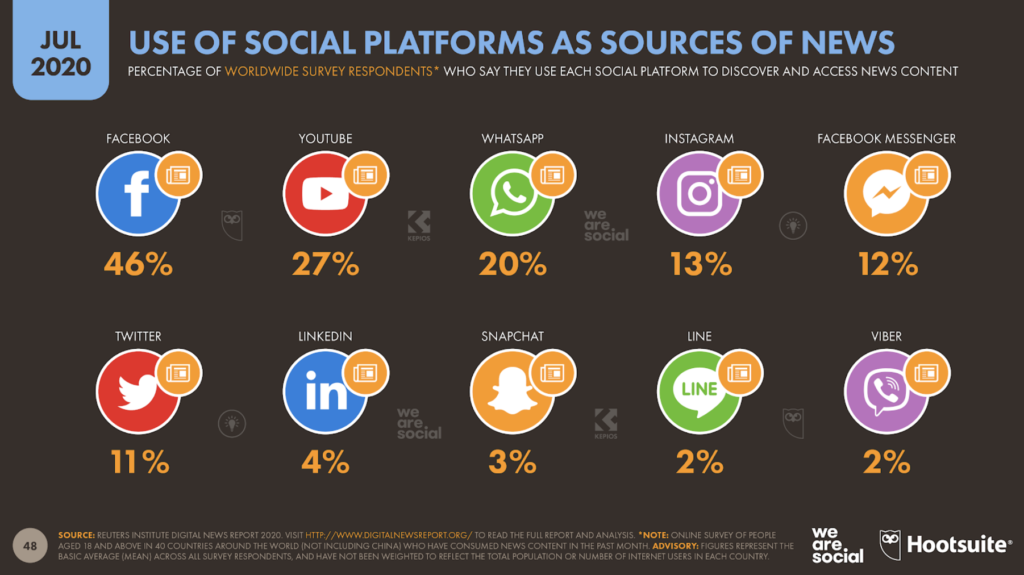

In the UAE, search engines have overtaken social media as the top way people discover brands: a reversal of recent years where social platforms dominated discovery. In Saudi Arabia, 32.2% of users are actively searching for brands, rather than waiting to be served content in their social feeds.

People aren’t relying on social ads alone anymore. They’re proactively researching, comparing, and validating brands before they engage.

Brands need to shift their focus beyond ads:discovery now depends on creating content people actively search for. How-to videos, FAQs, and deep-dive explainers are driving engagement in a way that passive social feeds no longer do.

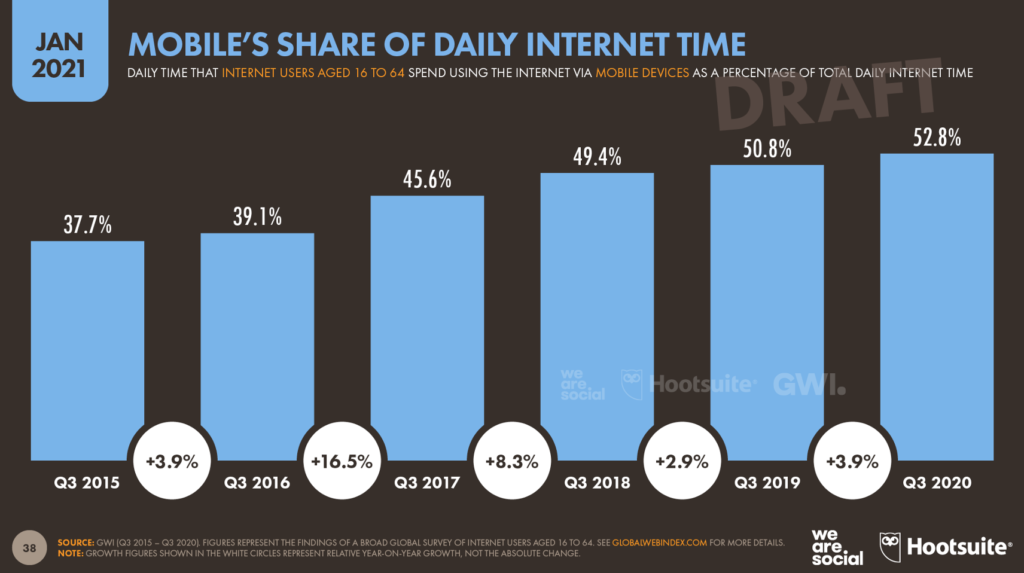

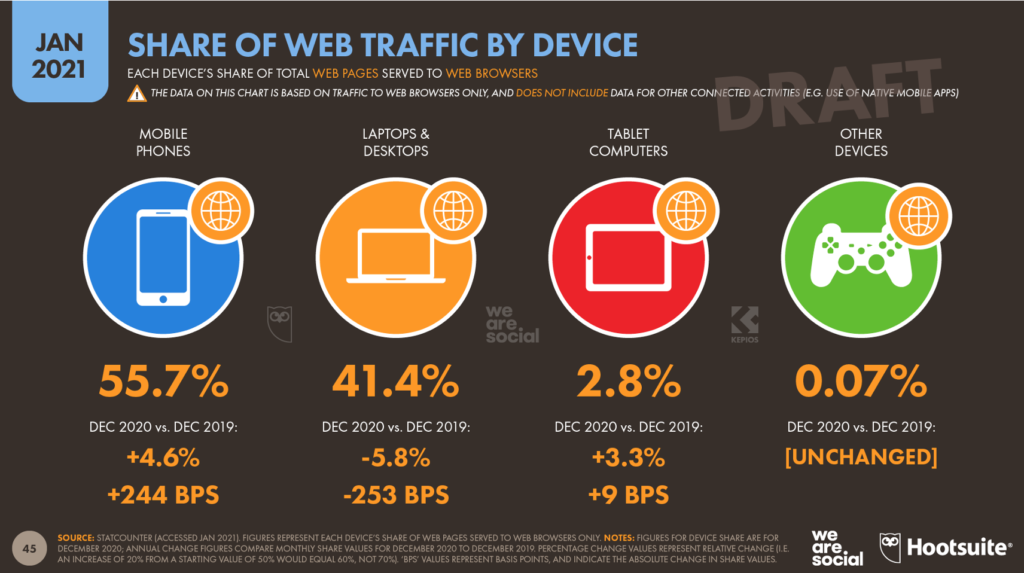

Shift #4: Mobile is the experience, and It’s becoming more fragmented

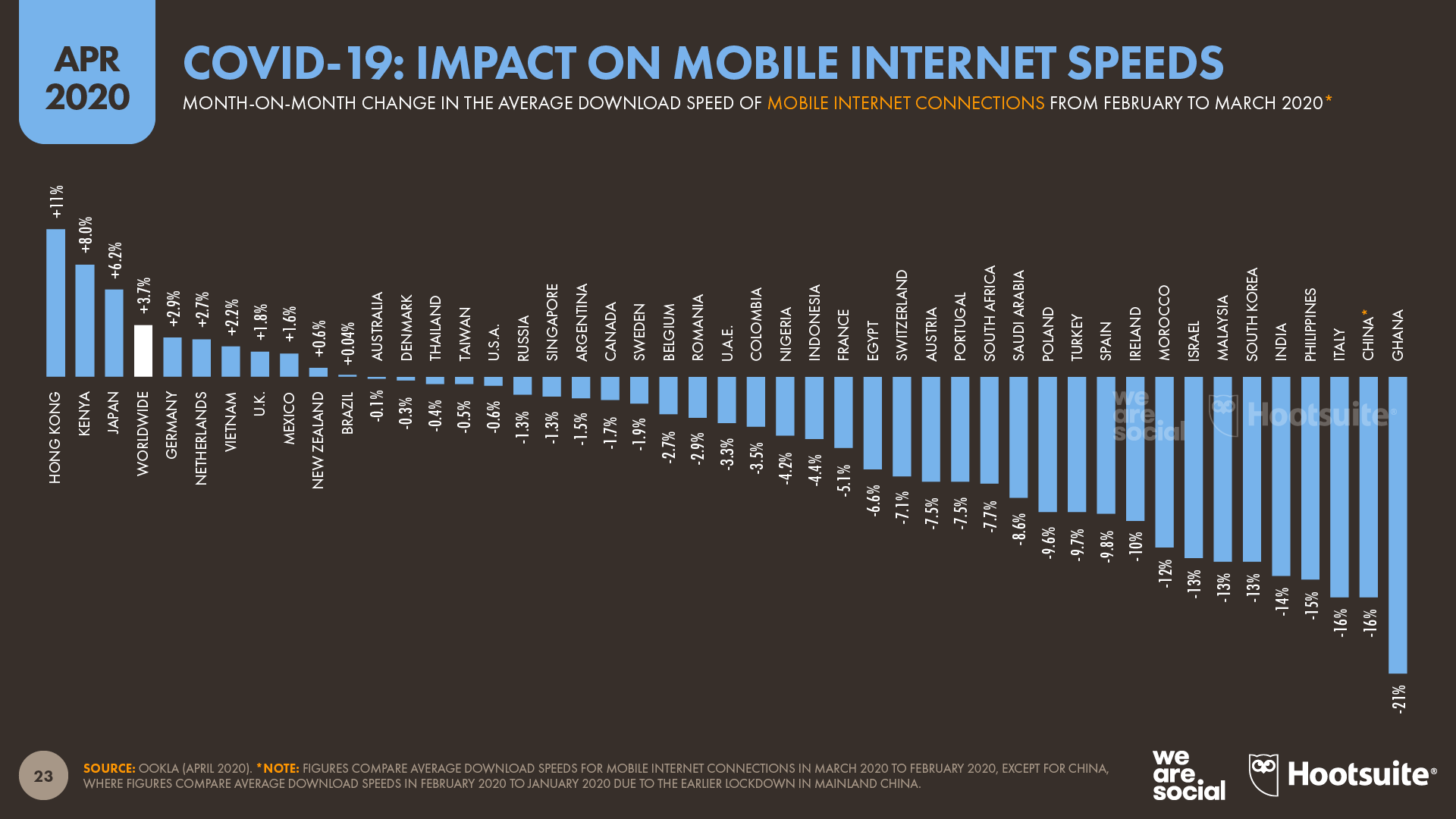

With mobile internet speeds in the UAE increasing by 50.7% YoY to 441.89 Mbps, and mobile penetration in KSA reaching 140%, consumers are juggling multiple devices, accounts, and contexts throughout the day.

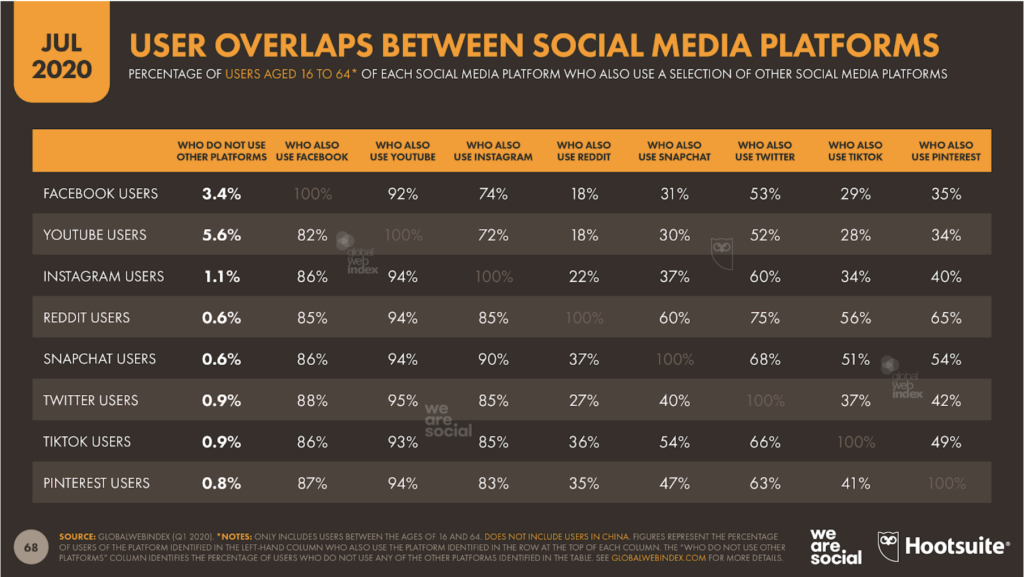

Content isn’t consumed in a straight line. Users move between work and personal accounts, switch devices throughout the day, and engage with both short and long-form content depending on context.Brands need to consider how users navigate across devices. Someone might be in work mode on LinkedIn, unwinding with TikTok, and catching up on Instagram Stories later. Digital behavior isn’t one-dimensional, and strategies should adapt to how and when people engage.

TL;DR Digital Shifts Defining 2025

The Digital 2025 reports make one thing clear: digital in the UAE and KSA is evolving, and so should your 2025 playbook.

-

Engagement now defines success. With social media fully saturated, users are more selective about the content they engage with. Content that doesn’t provide value sees lower interaction.

-

Platform dynamics are shifting. LinkedIn continues to grow, TikTok remains central to cultural conversations. Understanding platform behaviors is becoming more important than just maintaining a presence.

-

Search is playing a larger role in brand discovery. More users are actively searching for information rather than relying solely on ads. Visibility depends on being easily discoverable through search.

-

Mobile usage is more dynamic than ever. Users switch between devices and contexts throughout the day. A uniform approach to content and engagement may not be as effective across different touchpoints.

So, What’s Next?

The Digital 2025 reports don’t just track changes—they define what should be in your 2025 playbook. Social strategies need to shift from just posting content to earning attention, optimizing for discovery, and adapting to fluid digital experiences.

Get the full UAE & KSA reports now to see how the landscape is evolving and what it means for the year ahead.

But beyond tasty trivia, what does all of this data tell us about what people are actually doing online? You’ll find my handy summary of all this year’s top trends below, but if you’d like to dig into any of these stories in more detail – together with some other stories that aren’t included here – head over to

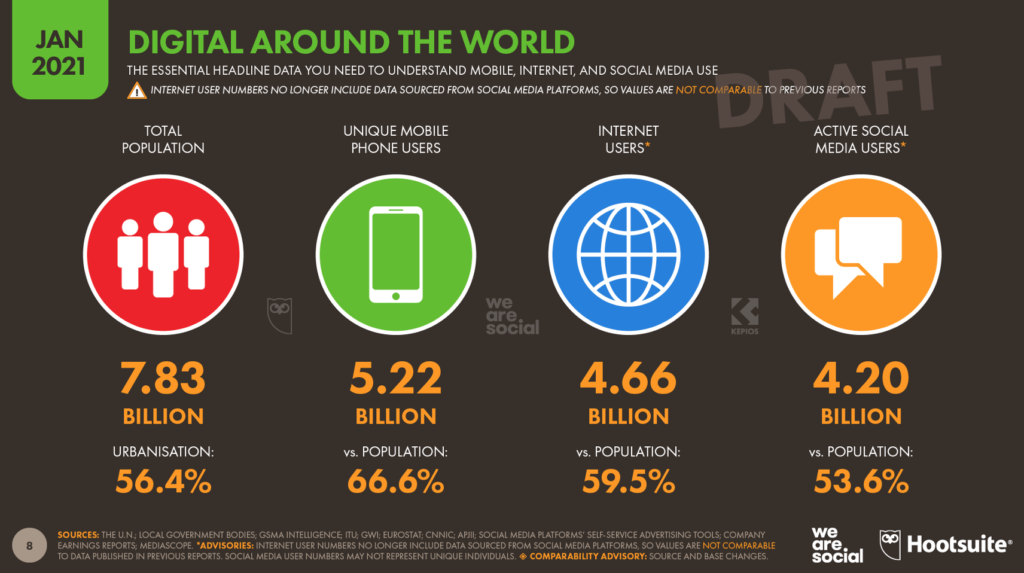

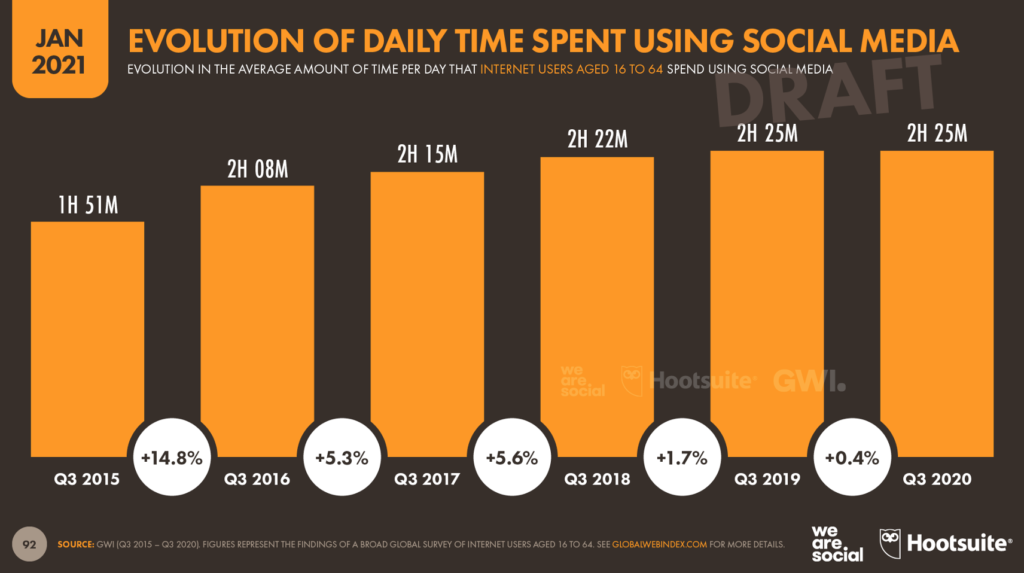

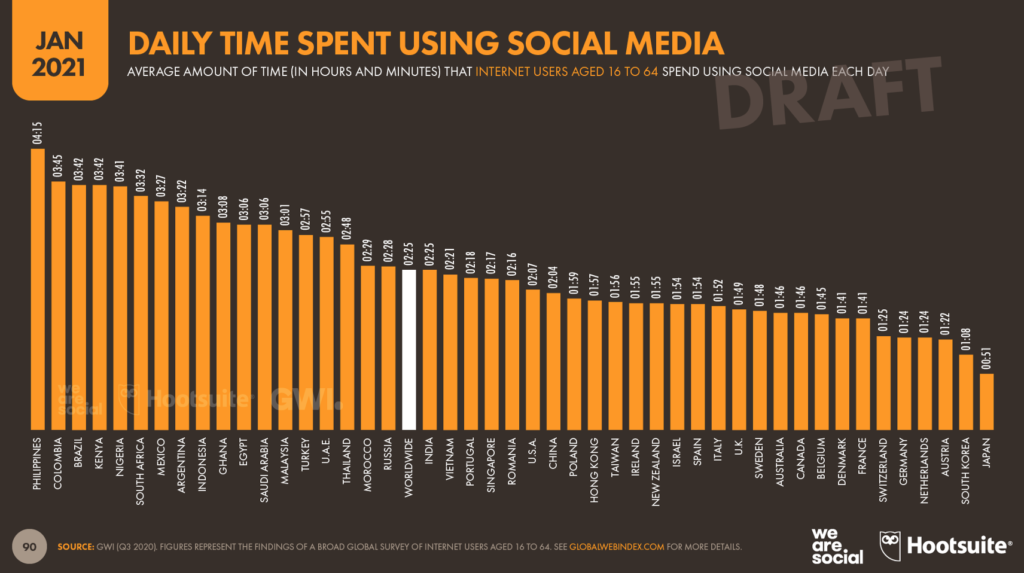

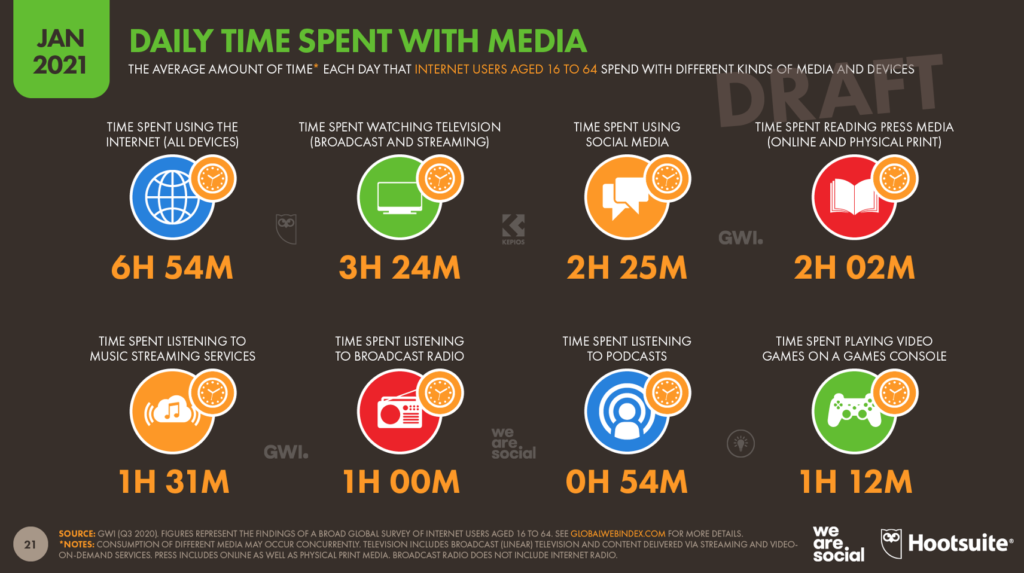

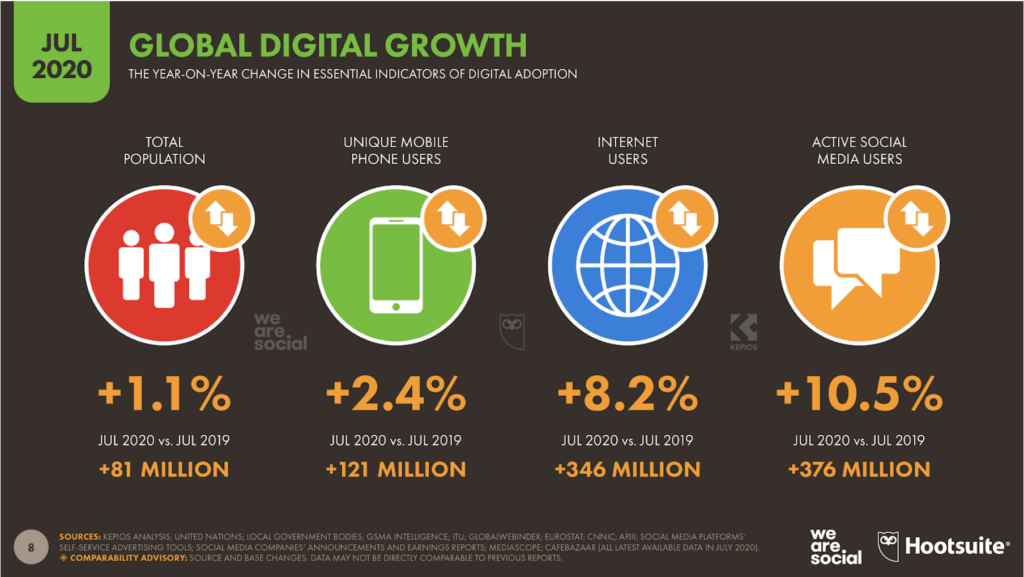

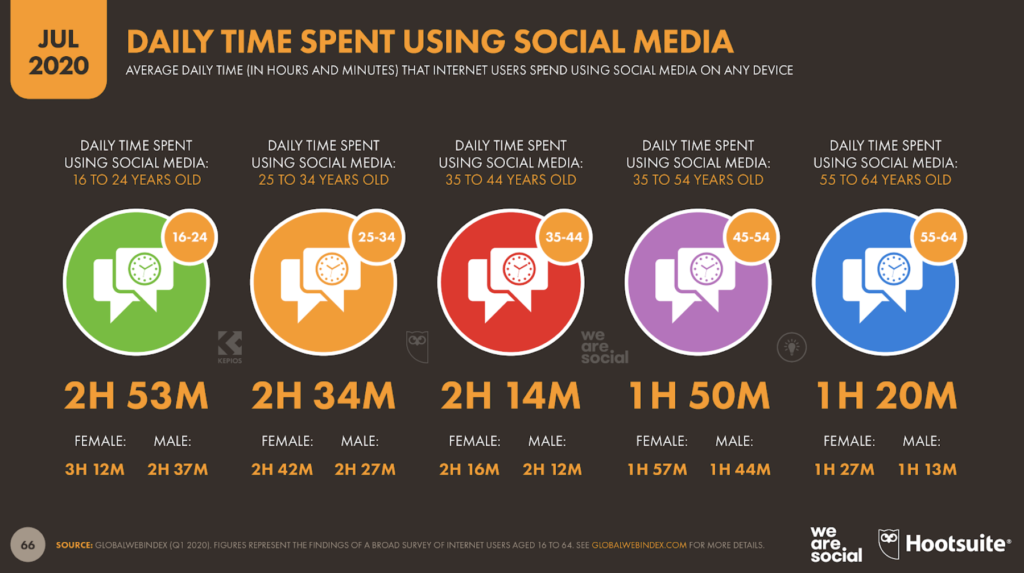

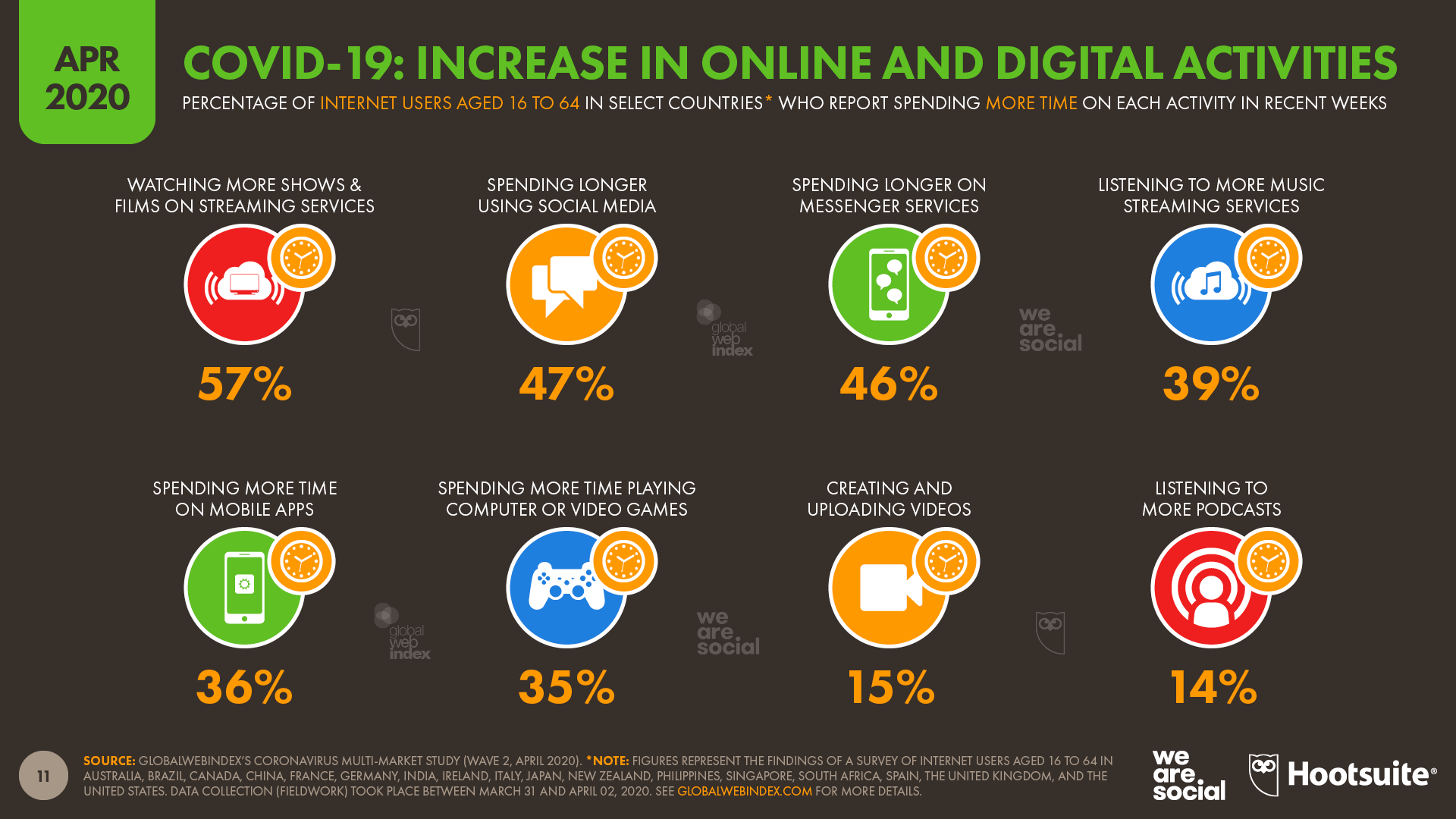

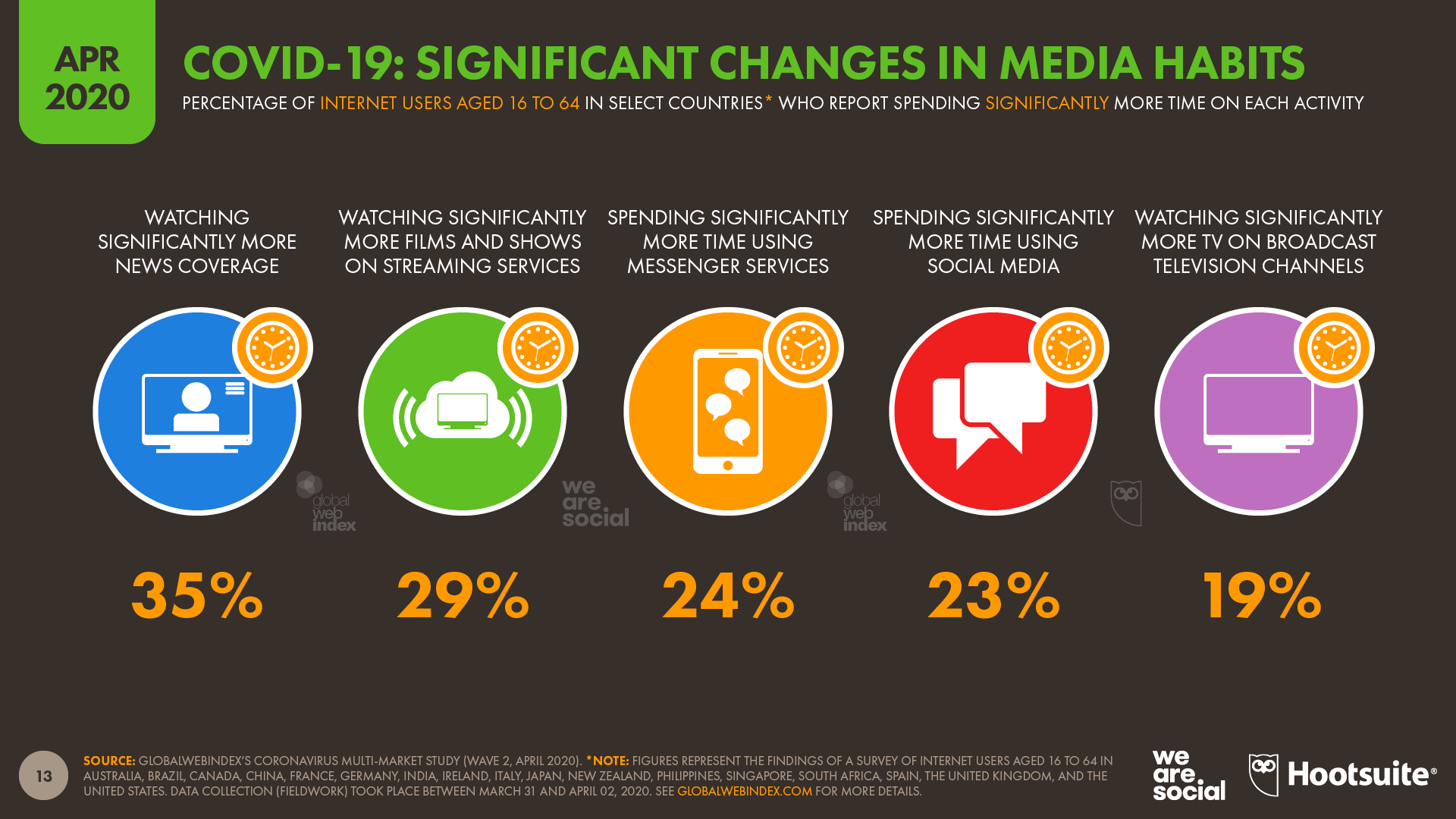

But beyond tasty trivia, what does all of this data tell us about what people are actually doing online? You’ll find my handy summary of all this year’s top trends below, but if you’d like to dig into any of these stories in more detail – together with some other stories that aren’t included here – head over to  The typical social media user now spends 2 hours and 25 minutes on social media each day, equating to roughly one waking day of their life every week.

The typical social media user now spends 2 hours and 25 minutes on social media each day, equating to roughly one waking day of their life every week.  Added together, the world’s social media users will spend a total of 3.7 trillion hours on social media in 2021 – equivalent to more than 420 million years of combined human existence. As we’ve seen in

Added together, the world’s social media users will spend a total of 3.7 trillion hours on social media in 2021 – equivalent to more than 420 million years of combined human existence. As we’ve seen in

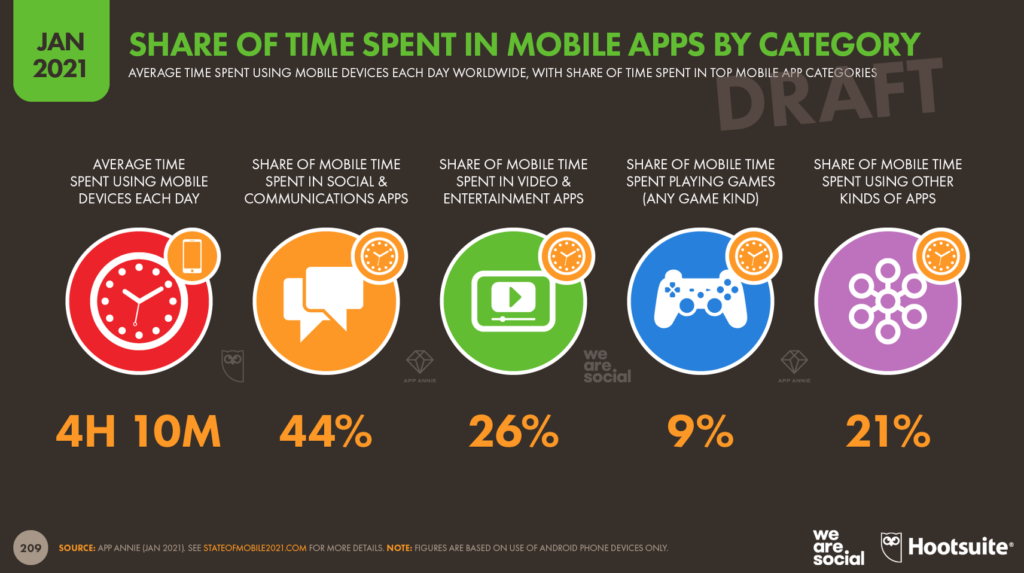

App Annie’s

App Annie’s

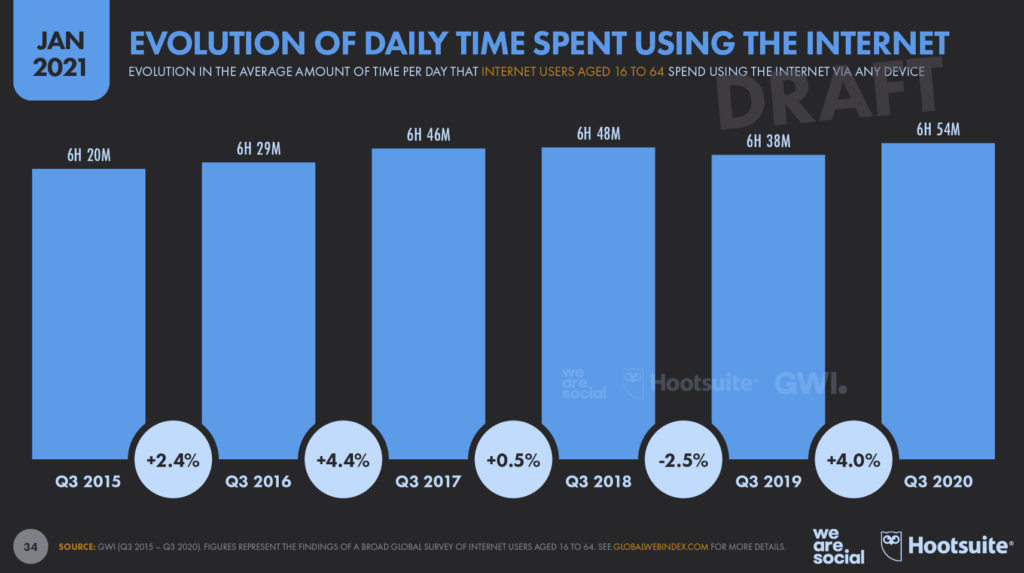

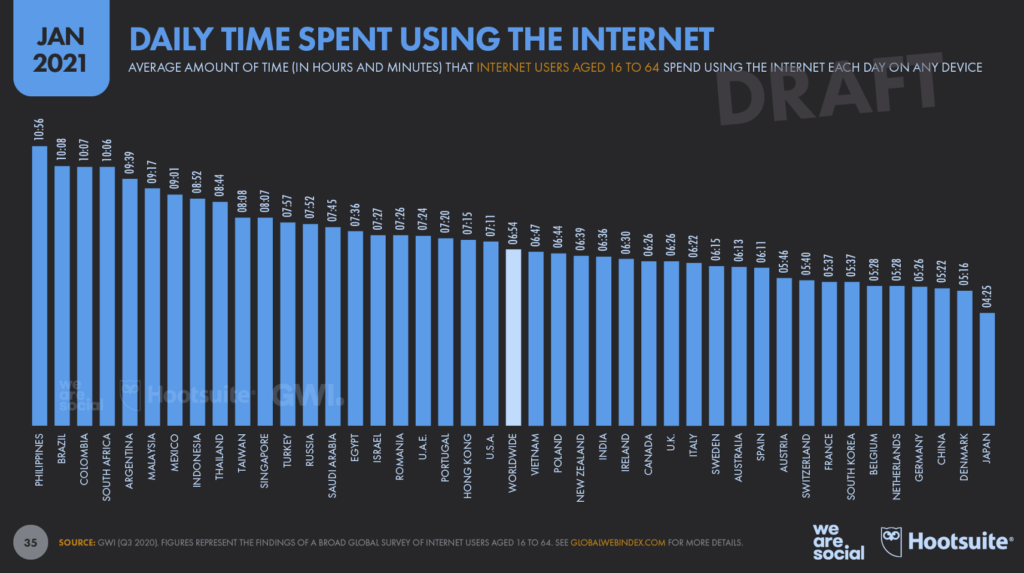

If internet use remains at these levels throughout 2021, the world’s internet users will spend almost 12 trillion hours online this year, which translates to more than 1.3 billion years of combined human time. However, as we saw in

If internet use remains at these levels throughout 2021, the world’s internet users will spend almost 12 trillion hours online this year, which translates to more than 1.3 billion years of combined human time. However, as we saw in

However, the latest research from

However, the latest research from

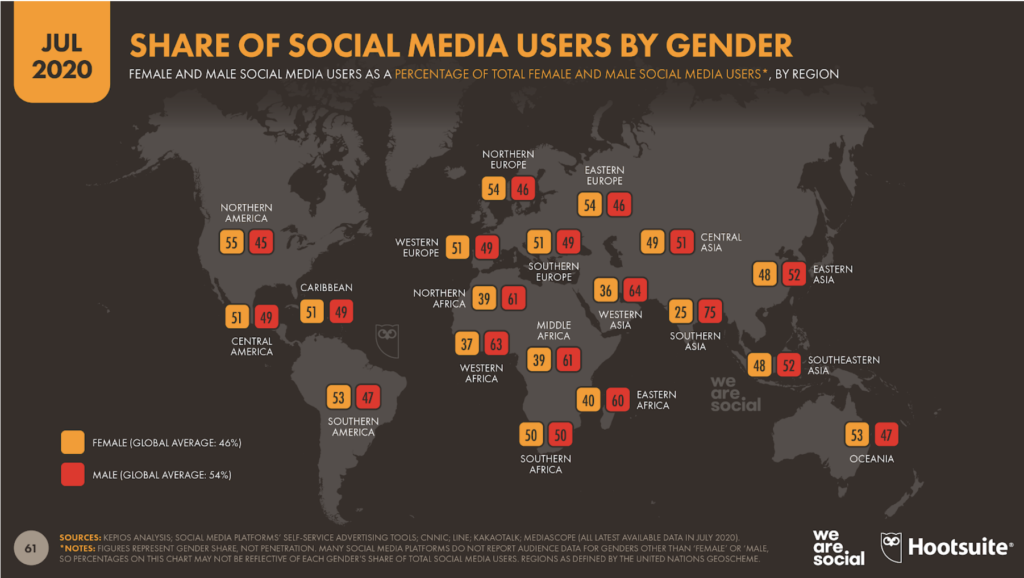

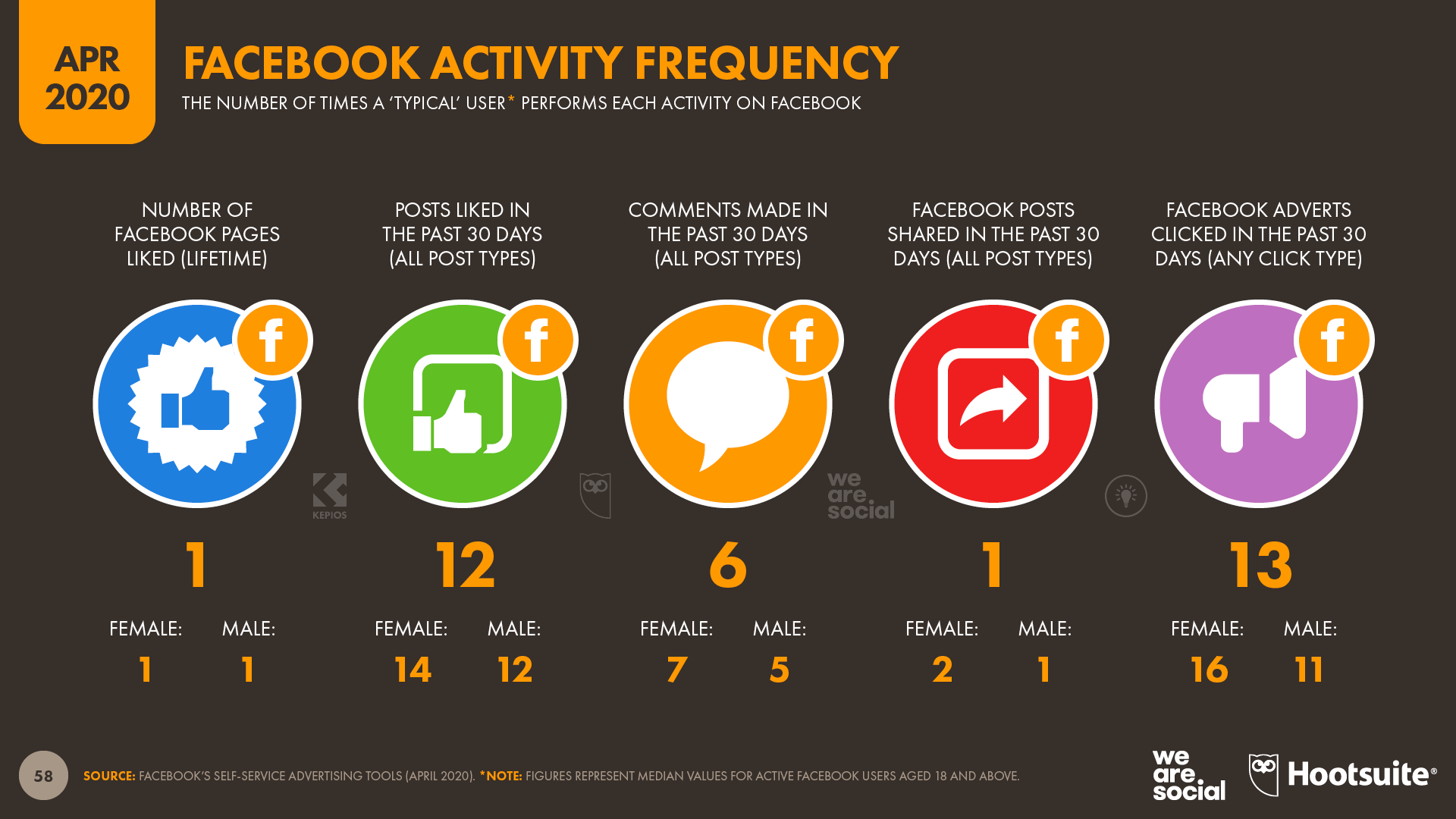

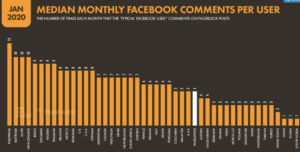

Saudi social media users leave on average 4 comments per month on Facebook posts (behind the global average of 5), and click on average 8 times per month on Facebook posts (behind the global average of 12).

Saudi social media users leave on average 4 comments per month on Facebook posts (behind the global average of 5), and click on average 8 times per month on Facebook posts (behind the global average of 12).